-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Teletext

Please enter a stock code or name to get quote details.

| Day High | -- | Day Low | -- |

| Open | -- | Prev. | -- |

| Turnover | -- | Volume | -- |

| Day Change | -- | Lot Size | -- |

| Lot Amount | -- |

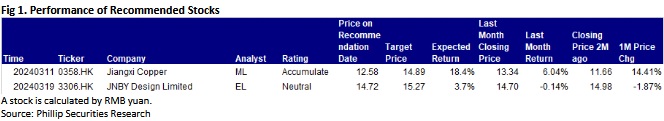

Report Review of March 2024

Wednesday, April 24, 2024  1302

1302

Report Review of March 2024

Weekly Special - 3306 JNBY Design Limited

Sectors:

Utilities, Commodity & Metals ( Margaret Li ),

TMT, Semiconductors, Consumer & Healthcare (Eric Li)

Utilities, Commodity & Metals (Margaret Li)

This month I released reports of Jiangxi Copper Company Limited(358).

In the first three quarters of 2023 (January to September), the company's total operating revenue was 399.56 billion yuan (RMB, the same as below), a year-on-year increase of 8.53%; the total operating cost was 393.48 billion yuan, a year-on-year increase of 8.83%; operating profit was 6.49 billion Yuan, a year-on-year increase of 4.16%; of which the net profit attributable to shareholders of the parent company was 4.94 billion yuan, a year-on-year increase of 4.54%. Basic earnings per share was 1.43 yuan, a year-on-year increase of 4.54%. The company's total operating income in the third quarter was 132.03 billion yuan, a year-on-year increase of 16.93%; the net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses was 1.44 billion yuan, a year-on-year increase of 30.03%. The performance mainly due to the relatively active domestic policies and demand from real estate and new energy sectors are strong, which keeps copper inventories at a low level and provides certain support for copper prices.

The company is committed to accelerating project construction with higher efficiency. Thecopper cathode project with an annual capacity of 180,000 tonnes of JCC Guoxing was successfully put into operation; the fine copper wire expansion project with an annual capacity of 10,000 tonnes of JCC Copper Products commenced coordinated commissioning in late June; the landmark sub-projects of phase III of the extension project of Wushan Copper Mine, such as 1,000-metre main shaft and auxiliary shaft were completed three months ahead of schedule; the 5,000 tonnes/day open pit project of Yinshan Mining completed all preparation works for comprehensive commencement of construction. In addition, the company has also achieved certain results in technological innovation. The “diamond-copper” product, a high-end chip cooling material developed by the Company, delivered outstanding performance in the trial mass application and had a great appeal to target customers, and the Company will seek cooperation to advance commercialisation in the future. The 6N high-purity copper, the raw material to break high-tech stranglehold in the fields of high-end electronic manufacturing and aviation, completed the midpoint testing research. The heat-proof and anti-corrosion 4N rhenium powder for use in alloys was tried out by high new technology enterprises and was highly recognised in the market. The high-performance oxygen-free copper rods for use in new energy vehicles achieved low-cost and large-scale production and sales. In addition, the company paid attention to energy conservation and emission reduction, the company recorded a period-on-period decrease of 1.39% in total energy consumption and an overall decline of about 18,000,000 kWh in purchased electricity in the first half of the year. And the company introduced new energy electric heavy-duty dump trucks in mines to apply new energy scenarios for the first time.

TMT, Semiconductors, Consumer, Healthcare (Eric Li)

This month I released reports of JNBY Design Limited (3306.HK).

Founded in 1994 and listed on the Hong Kong Stock Exchange in 2016 (stock code: 03306), JNBY is designer group in China and is headquartered in Hangzhou, China. JNBY design and sell fashion apparel, footwear, accessories and home products under a portfolio of brands in three stages, including mature brand representing JNBY, younger brands representing CROQUIS, jnby by JNBY and LESS, and emerging brands representing POMME DE TERRE, JNBYHOME. As of December 31, 2023, the total number of standalone retail stores around the world is 2,036 (including "JNBY Group +" multi-brand collection stores), sales network has covered all provinces, autonomous regions and municipalities in Mainland China and across nine other countries and regions around the world.

The total revenue for the six months ended December 31, 2023 (1HFY2024) amounted to RMB2,976 million, an increase of 26.1% YoY. The increase in revenue was mainly due to the increase in same store sales of offline shops, the growth in the sales of online channels and the increase in the scale of offline stores. Net profit was RMB574 million, representing an increase of 54.5% YoY; Net profit margin increased by 3.5 percentage points to 19.3%. The basic EPS were RMB1.14, an increase of 54.1% YoY, with an interim dividend of HK$0.46 per share (equivalent to RMB0.42 per share) and a special interim dividend of HK$0.39 per share (equivalent to RMB0.36 per share), totaling HK$0.85 per share.

1HFY2024, the gross profit increased by 27.6% YoY to RMB1,948 million; The overall gross profit margin increased by 0.8 percentage points to 65.5% , which was mainly attributable to the enhancement of the comprehensive brand equity. The selling and marketing expenses accounted for 31.1% (1HFY2023: 34.6%). The decrease in the expense ratio as compared to the first half of fiscal year 2023 was mainly attributable to the increase in the overall revenue and the improvement of operating efficiency.

As of December 31, 2023, the company had over 7.4 million membership accounts (without duplication) (as of June 30, 2023: over 6.9 million). The retail sales contributed by the members of the company accounted for over 80% of the total retail sales. The number of active members accounts of the company (without duplication) was over 550,000 (2022: over 420,000), and the number of active members accounts was significantly higher than that in 2022. The number of membership accounts with annual purchases totaling over RMB5,000 was over 300,000 (FY2022: over 220,000), and the retail sales contributed by those membership accounts reached RMB4.33 billion (FY2022: RMB2.93 billion), accounting for over 60% of the total retail sales from offline channels.

Top of Page

|

請即聯絡你的客戶主任或致電我們。 市場拓展部 Tel : (852) 2277 6666 Email : marketing@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|